what is a fit deduction on paycheck

A paycheck to pay for retirement or health benefits. On a pay stub this tax is abbreviated SIT which stands for state income tax.

Solved Federal Taxes Not Deducted Correctly

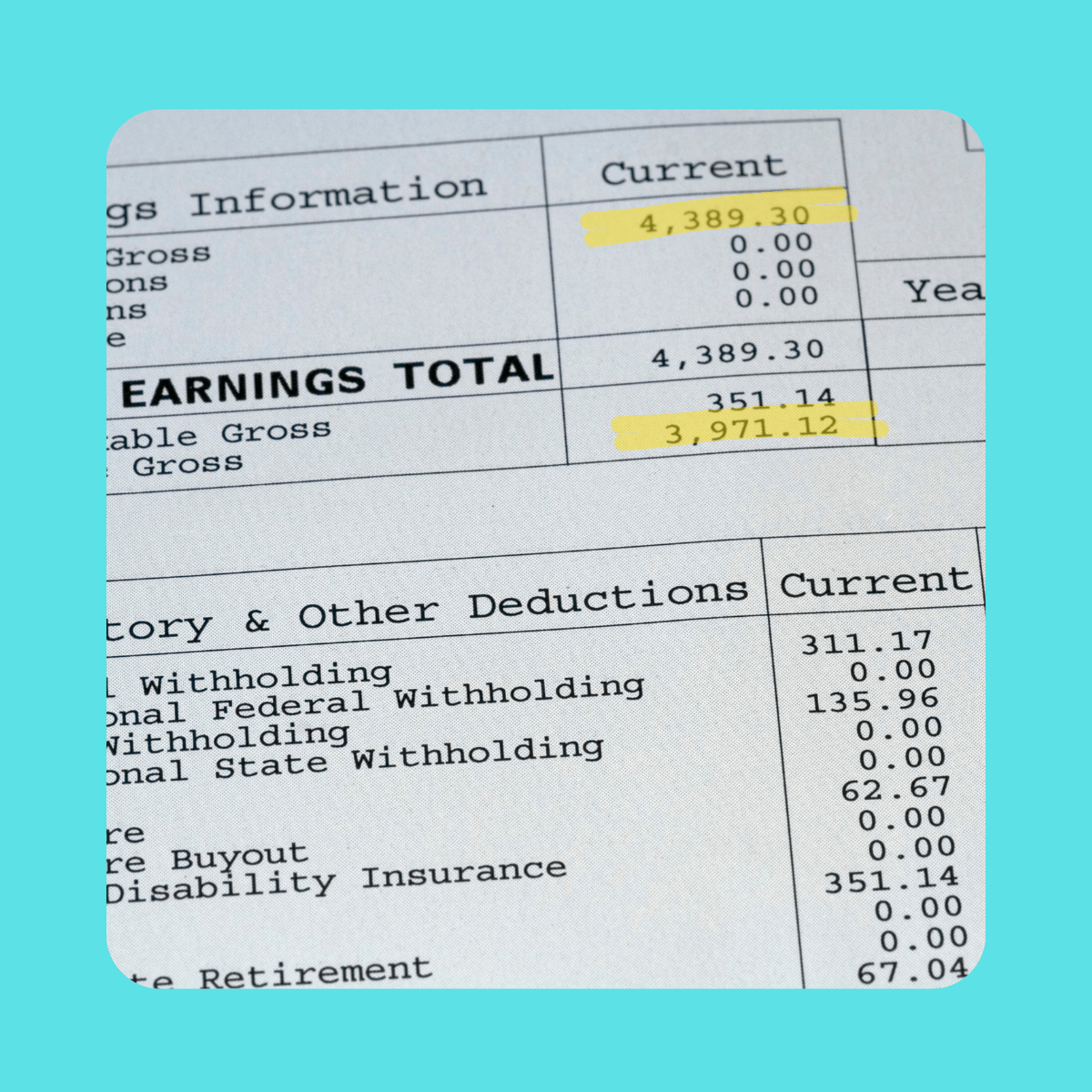

Paycheck stubs are normally divided into 4 sections.

. The federal income tax rates remain unchanged for the 2020 and 2021 tax years. Both FICA and FIT are large components of the Federal governments revenues used to pay current expenses. FIT deductions are typically one of the largest deductions on an earnings statement.

For 2022 employees will pay 62 in Social Security on the first 147000 of wages. The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken. For a long time the government has run on a deficit meaning the current expenses exceed current revenues.

Federal income tax is withheld from an employees earnings such as regular pay bonuses and commissions in addition to other types of earnings. What is the fit tax rate for 2020. Every individual is required to pay federal income taxes on their taxable earnings that can include wages salaries bonuses tips or others.

Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle. My tax return could use such a brilliant deduction. The employee is responsible for this amount and the FIT tax is drawn from each of their paychecks.

The income brackets though are adjusted slightly for inflation. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. FICA taxes consist of Social Security and Medicare taxes.

The employee is responsible for this amount and the fit tax is. The percentage method is based on the graduated federal tax rates 0 10 12 22 24 32 35 and 37 for individuals. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. They are all different taxes withheld. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

Employers withhold FIT using either a percentage method bracket method or alternative method. The amount of money you. Fit is the amount required by law for employers to withhold from wages to pay taxes.

Payroll taxes and income tax. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. Payroll taxes and income tax.

If you make 75000 a year your hourly wage is 750002080 or 3606. Withholding is one way of paying income taxes to the. These items go on your income tax return as payments against your income tax liability FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

FIT is applied to taxpayers for all of their taxable income during the year. However they dont include all taxes related to payroll. Find the section of the stub thats labeled gross pay salary or something similar.

With this information you can prepare for tax season. FICA taxes are commonly called the payroll tax. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes.

What is a fit deduction on paycheck. These amounts are paid by both employees and employers. Employers withhold or deduct some of their employees pay in order to cover.

A paycheck stub summarizes how your total earnings were distributed. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. These are matched by your employer.

Some are income tax withholding. FIT deductions are typically one of the largest deductions on an earnings statement. These withholdings constitute the difference between gross pay and net pay and may include.

The rate is not the same for every taxpayer. Federal income taxes are calculated and withheld when an employee is paid. 10 12 22 24 32 35 and 37.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Take a look at your pay stubany amount labeled as fica is a contribution to those two federal programs. FIT Fed Income Tax SIT State Income Tax.

FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. In a nutshell you see FIT tax on your paycheck as your employer is required to withhold a certain amount of money as federal income tax FIT from your earnings. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

Subsequently question is what are the required deductions from your paycheck. For a hypothetical employee with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

The withholdings are then remitted to the IRS on a regular basis depending on the employers payroll schedule. FIT stands for federal income tax. Money may also be deducted or subtracted from.

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. Personal and Check Information. Mandatory Payroll Tax Deductions.

Can Fit Deductions Be Rounded Up In Qbo Payroll

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Accounting Basics

Free 8 Sample Medical Invoice Templates In Ms Word Pdf Invoice Template Bill Template Medical Billing

Explore Our Sample Of Employee Pay Increase Template For Free Salary Increase Templates Wine Label Template

Can Fit Deductions Be Rounded Up In Qbo Payroll

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Credit Com

Mathematics For Work And Everyday Life

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Payroll Deduction Authorization Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates Printable Free

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Job Description Template Checklist Template Resume Template

What Is A Pay Stub Loans Canada

Mathematics For Work And Everyday Life

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com